Divorce brings major financial changes that require careful planning and organization. Without proper preparation, you risk overlooking important assets or making costly mistakes.

We at Mediation First NJ LLC have seen how a comprehensive divorce financial planning checklist helps people protect their financial future. This guide walks you through the essential steps to take control of your finances during this transition.

What Financial Information Do You Need Before Filing?

Collect Your Complete Financial Picture

Start to gather financial documents immediately, even before you file divorce papers. The average divorce costs $12,780 according to Nolo research, and incomplete documentation drives up these expenses significantly. You need bank statements from the past three years, tax returns, investment account statements, retirement plan documents, and property deeds. Include credit card statements, loan documents, and business financial records if applicable. California requires complete financial disclosure including all tax returns filed within the two years prior to filing. Missing documents can delay proceedings and increase legal costs. Create digital copies and store them securely in multiple locations.

Determine Your True Net Worth

Calculate your net worth when you list every asset and debt at current market values. Assets include checking accounts, savings, investments, retirement funds, real estate, vehicles, and personal property. Debts encompass mortgages, credit cards, student loans, and other obligations. In community property states like California, Texas, and Arizona, debts acquired during marriage belong equally to both spouses regardless of whose name appears on the account. Get professional appraisals for significant assets like homes, businesses, or valuable collections. This baseline prevents disputes later and helps you negotiate fairly.

Map All Income and Expense Sources

Document every income stream including salaries, bonuses, rental income, investment dividends, and side business earnings. Track monthly expenses across categories like housing, utilities, insurance, food, transportation, and discretionary spending. Child support calculations consider both parents’ complete income pictures, so accuracy matters. Spousal support determinations also depend on thorough income documentation. Use three months of bank statements to identify recurring expenses you might forget. This analysis reveals your post-divorce financial needs and helps establish realistic support requests.

Once you have this complete financial foundation, you can make informed decisions about the major financial choices that lie ahead in your divorce proceedings.

What Financial Decisions Shape Your Divorce Settlement?

Property Division Strategy

Property division determines your financial foundation after divorce. In community property states, judges split marital assets equally, while equitable distribution states consider factors like marriage length and each spouse’s contributions. Real estate typically represents the largest marital asset, with median home values continuing to rise in today’s market. You face three main options: sell and split proceeds, one spouse buys out the other, or continue co-ownership. Buyouts require accurate appraisals and sufficient liquid assets or financing. Retirement accounts need Qualified Domestic Relations Orders (QDROs) for tax-free transfers between spouses. Investment portfolios should be divided with tax implications in mind, as capital gains taxes can reach 20% for high earners. Business valuations require professional assessment, especially for closely-held companies where one spouse actively participates.

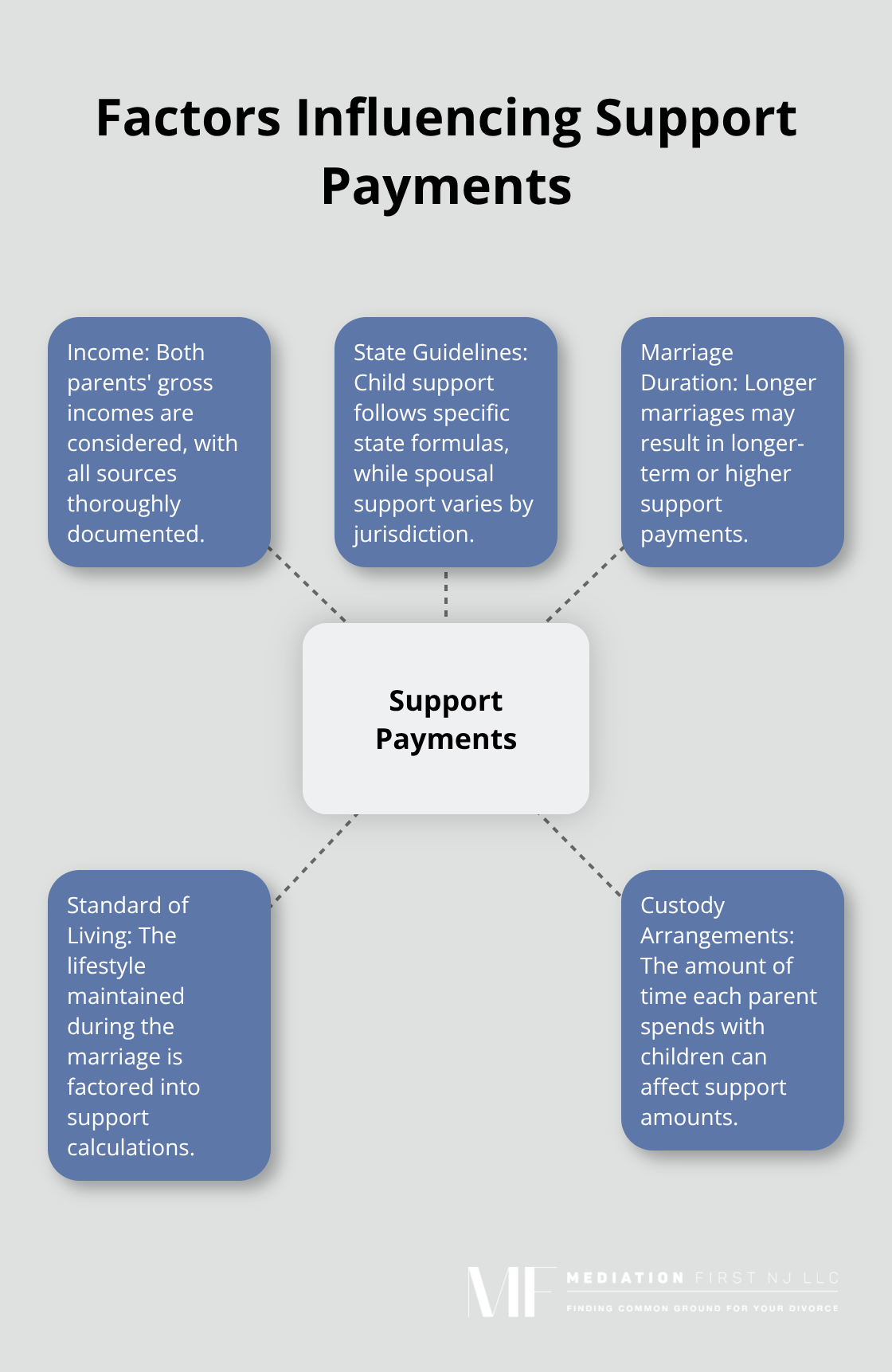

Support Payment Calculations

Spousal support varies dramatically by state, with some states like Texas rarely awarding alimony while others like California use detailed formulas. Duration typically ranges from half the marriage length for unions under 10 years to indefinite support for marriages exceeding 20 years. Child support follows state guidelines based on both parents’ gross incomes, with the average monthly payment totaling $441 nationwide. Additional costs like health insurance, childcare, and educational expenses often split proportionally based on income. Higher-earning spouses in states like New York can pay combined support exceeding $10,000 monthly. Courts consider factors like earning capacity, standard of living during marriage, and custodial arrangements. Document all income sources thoroughly, as unreported income discovered later can trigger significant modifications and penalties.

These major financial decisions set the stage for your post-divorce financial reality, making it essential to develop comprehensive strategies for managing your new financial independence.

How Do You Rebuild Your Financial Life After Divorce?

Establish Your New Financial Foundation

Your post-divorce budget demands immediate attention because your household income typically drops significantly while fixed expenses like housing and insurance remain unchanged. Start with your actual monthly income, then subtract non-negotiable expenses that include housing, utilities, insurance, and debt payments. Research shows that employed individuals who went through a divorce in the past 12 months earned less than those who did not. Build an emergency fund equal to six months of expenses as your top priority, since divorced individuals face higher financial volatility.

Cut discretionary expenses ruthlessly for the first year while you stabilize. Cancel subscriptions, downsize your home if necessary, and consider additional income sources. Track every expense with apps like Mint or YNAB to identify leaks that can derail your recovery.

Secure Your Insurance and Estate Plans

Update all insurance policies and beneficiary designations within 30 days of your divorce finalization. Remove your ex-spouse from life insurance policies unless court-ordered otherwise, and add your children or other family members as primary beneficiaries. Health insurance presents immediate challenges, as COBRA coverage can be expensive for family coverage.

Shop marketplace plans during special enrollment periods that divorce triggers. Disability insurance becomes more important as a single parent, since you lack a spouse’s income as backup protection. Update your will, power of attorney documents, and healthcare directives to reflect your new circumstances.

Adjust Your Investment Strategy

Reassess your risk tolerance and investment timeline as a single person with different financial goals. Women face particular retirement challenges and need 20% more savings than men due to longer lifespans and career interruptions. Maximize retirement contributions immediately, especially if you received retirement assets through your divorce settlement.

Roll over any assets from your ex-spouse’s employer plans into your own IRA within 60 days to avoid tax penalties. Rebalance portfolios toward your new risk profile, which may be more conservative given reduced household income. Consider working with a fee-only financial advisor who charges hourly rates rather than percentage-based fees, as your assets may be temporarily reduced.

Plan for Long-Term Security

Social Security benefits based on your ex-spouse’s record become available if you were married at least 10 years, potentially providing $1,500+ monthly at full retirement age. File for these benefits at your full retirement age to maximize payments, and note that claiming them doesn’t reduce your ex-spouse’s benefits.

Review your credit reports from all three bureaus and dispute any errors that may have occurred during the divorce process. Establish credit in your name only by opening new accounts and making consistent payments. Monitor your credit score monthly, as divorced individuals often see temporary drops due to account changes and increased debt loads.

Final Thoughts

This divorce financial planning checklist provides the roadmap you need to protect your financial future during one of life’s most challenging transitions. Each step builds toward your financial independence, from complete financial documentation and net worth calculations to informed decisions about property division and support payments. The complexity of divorce finances demands professional expertise that can save you thousands of dollars in mistakes.

Tax implications, retirement account transfers, and property valuations require specialized knowledge that prevents costly oversights. Qualified professionals position you for long-term success through their expertise. Working with the right team protects your interests and maximizes your financial recovery potential.

We at Mediation First NJ LLC help New Jersey families reach mutually acceptable agreements through constructive communication rather than adversarial litigation (which reduces costs significantly). Our mediation services empower you to make informed decisions that serve your family’s best interests. Your financial recovery starts with taking control of the process and choosing the right professional support.