Divorce proceedings can devastate your financial future if assets aren’t properly protected. Financial mediation divorce offers a strategic alternative to costly litigation battles.

We at Mediation First NJ LLC help couples navigate complex asset division while maintaining control over their financial outcomes. This approach saves both money and preserves wealth that traditional court battles often destroy.

How Does Financial Mediation Work in New Jersey

Financial mediation places decision-making power directly in your hands rather than leaves critical asset decisions to a judge who knows nothing about your family’s unique circumstances. New Jersey couples who use mediation typically resolve their financial disputes 60% faster than those who pursue traditional litigation, according to data from the New Jersey Administrative Office of the Courts. This process addresses every financial aspect of your marriage dissolution, from retirement accounts worth hundreds of thousands of dollars to spousal support arrangements that protect both parties’ long-term financial security.

What Financial Mediation Covers

Financial mediation encompasses comprehensive asset division that includes real estate portfolios, business valuations, investment accounts, and debt allocation. The process also handles alimony calculations based on New Jersey’s statutory factors, child support determinations that use state guidelines, and tax-efficient property transfers. Unlike court proceedings where judges impose rigid solutions, mediation allows couples to craft creative arrangements such as structured buyouts of business interests or phased asset transfers that minimize tax consequences.

Why Mediation Beats Litigation

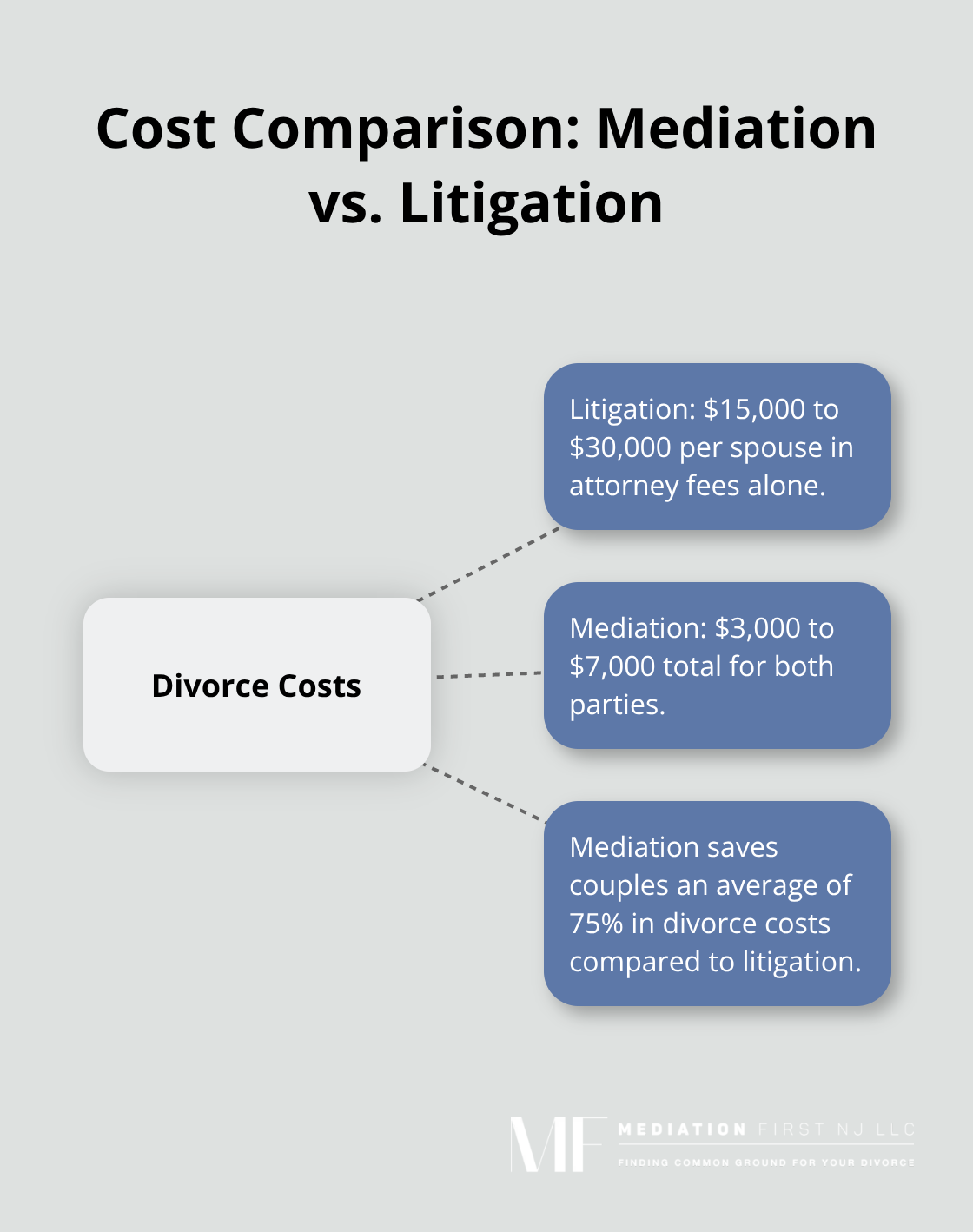

Traditional divorce litigation costs New Jersey couples an average of $15,000 to $30,000 per spouse in attorney fees alone, while mediation typically costs $3,000-$7,000 total for both parties. Litigation exposes your private financial information through public court records, while mediation maintains complete confidentiality. Court battles can stretch 18 to 24 months (during which assets may lose value or generate unnecessary tax liabilities), whereas mediated agreements often reach completion within 3 to 6 months.

The Mediation Process Timeline

Most financial mediation cases follow a structured timeline that begins with initial disclosure sessions where both parties present complete financial documentation. The mediator then facilitates discussions about asset valuation and division priorities over 4 to 8 sessions. Each session typically lasts 2 hours and focuses on specific financial components such as retirement accounts, real estate, or business interests. This systematic approach prevents the emotional overwhelm that often derails court proceedings and keeps couples focused on practical solutions.

The structured nature of this process sets the stage for understanding how to protect your most valuable assets through strategic identification and valuation techniques.

Asset Protection Strategies During Mediation

Separate Property Documentation Saves Your Wealth

New Jersey courts recognize a fundamental distinction between marital and separate property, yet many spouses lose thousands in assets due to inadequate documentation. Separate property includes assets owned before marriage, inheritances received by one spouse, and gifts given specifically to one individual. You must prove separate property status through bank statements, deeds, inheritance documents, and gift letters. Assets purchased with separate funds retain their separate character only if you maintain clear paper trails that show the source of funds.

Separate assets lose their protected status when you mix them with marital funds. Real estate titled solely in one spouse’s name before marriage remains separate property unless the other spouse contributed to mortgage payments or improvements with marital funds. Courts examine every transaction to determine whether separate property became marital property through active management or contribution by both spouses.

Retirement Account Protection Requires Strategic Planning

Retirement accounts accumulated during marriage face division through Qualified Domestic Relations Orders which can have significant tax consequences if handled incorrectly. 401(k) plans, pension benefits, and IRAs require professional valuation to determine present value versus future benefit streams. Stock options and restricted stock units often vest according to complex schedules that affect their marital property classification.

Early withdrawal penalties and tax implications can destroy retirement wealth if you divide accounts improperly. Some retirement plans allow in-service distributions while others require separation from employment. The timing of asset division affects the total value each spouse receives and determines who bears the tax burden.

Investment Portfolio Valuation Demands Precision

Investment portfolios need current market valuations and consideration of capital gains implications. Individual stocks, mutual funds, and bonds fluctuate daily, making timing critical for fair division. Tax-loss harvesting opportunities may benefit one spouse more than the other depending on their individual tax situations.

Concentrated stock positions in employer shares create unique challenges because immediate sale may not be possible due to trading restrictions or market conditions. Options strategies and derivative positions require specialized knowledge to value accurately and divide equitably.

Business Interest Protection Strategies

Business interests demand forensic accounting to separate personal goodwill from enterprise value, particularly for professional practices where earning capacity intertwines with business assets. Partnership agreements and shareholder contracts may contain divorce-triggered buyout provisions that affect asset protection strategies. Professional practices often derive value from the owner’s personal reputation and client relationships rather than tangible assets.

Valuation methods vary significantly between asset-based approaches and income-based calculations. The choice of valuation date can impact the final settlement in volatile markets. These complex asset protection strategies require careful attention to tax implications and disclosure requirements that can make or break your financial future through family mediation services.

Common Financial Pitfalls to Avoid

Hidden Assets Create Legal Nightmares

New Jersey requires complete financial disclosure under oath, and courts treat asset concealment as perjury punishable by fines and jail time. Courts impose severe penalties including awarding hidden assets entirely to the innocent spouse plus attorney fees. Forensic accountants routinely trace financial records back five years and examine credit card statements, tax returns, and bank deposits to uncover concealed wealth. Cryptocurrency transactions, offshore accounts, and cash businesses face particular scrutiny because they offer easy concealment opportunities.

Incomplete disclosure during mediation destroys trust and often forces expensive litigation. Professional practices commonly undervalue goodwill or fail to disclose partnership distributions. Real estate transfers to family members within three years of divorce filing trigger automatic investigations. The New Jersey Family Court database tracks property transfers and business formations, which makes concealment nearly impossible.

Tax Consequences Devastate Settlement Values

Asset division decisions create immediate and long-term tax liabilities that many couples ignore until too late. Capital gains taxes on investment property sales can consume 20% to 37% of proceeds (depending on income levels and holding periods). Retirement account distributions before age 59½ trigger 10% early withdrawal penalties plus ordinary income taxes that can reach 40% combined rates in New Jersey.

Stock option exercises and restricted stock vesting create ordinary income recognition that pushes both spouses into higher tax brackets. Home sale exclusions of $250,000 per person require two-year ownership and residency requirements that divorce timing can disrupt. Alimony payments create tax deductions for payers and taxable income for recipients under current federal law. These tax implications often exceed $50,000 per spouse in high-asset cases.

Future Financial Needs Require Careful Analysis

Women’s household income falls by 41 percent with divorce, almost twice the decline that men experience according to the U.S. Government Accountability Office. Healthcare costs skyrocket when employer coverage ends, with COBRA premiums averaging $7,739 annually for individual coverage in New Jersey. College funding obligations continue despite divorce, and 529 plan ownership affects financial aid eligibility differently for custodial versus non-custodial parents.

Retirement planning requires recalculation because divided assets provide less compound growth time. Social Security benefits based on ex-spouse earnings require ten-year marriage duration, which makes divorce timing financially significant. Life insurance needs increase to replace lost spousal income and protect child support obligations. These planning failures create financial crises that mediation agreements should prevent through comprehensive future needs analysis.

Working with a coach can provide clarity and confidence to avoid costly mistakes during this complex process.

Final Thoughts

Financial mediation divorce protects your wealth while it preserves relationships that litigation destroys. The statistics speak volumes: mediation costs 75% less than court battles and resolves cases in months rather than years. You maintain complete control over asset division decisions instead of surrendering that power to judges who lack intimate knowledge of your financial situation.

Professional financial guidance becomes essential when retirement accounts exceed $100,000, business interests require valuation, or complex investment portfolios need division. Tax implications alone can cost tens of thousands if you handle them incorrectly. Forensic accountants and financial planners provide expertise that prevents costly mistakes during asset division negotiations (particularly with complex business valuations).

Your financial security depends on informed decisions you make now. Hidden assets create legal nightmares that destroy trust and force expensive litigation. We at Mediation First NJ LLC guide couples through complex asset protection while we maintain confidentiality and control over outcomes through professional mediation services. Take action today to secure your financial future through mediation rather than risk everything in court battles.